CHICAGO--(BUSINESS WIRE)--

Coeur Mining, Inc. (“Coeur” or the “Company”) (NYSE: CDE) today filed a NI 43-101 Technical Report (“technical report”) for its Kensington gold mine in Alaska, which reflects a 25% increase in proven and probable reserves to 620,700 ounces and a 10% increase in average reserve grade to 0.21 ounces per ton (“oz/t”), or 7.2 grams per tonne (“g/t”), compared to year-end 2016 reserves. Contained in this reserve is an initial reserve estimate for the high-grade Jualin deposit of 74,100 contained ounces of gold based on 157,600 tons of ore at an average grade of 0.47 oz/t, or 16.1 g/t.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20180425006688/en/

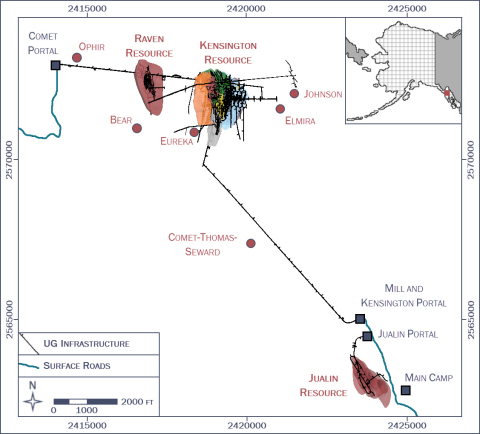

Kensington: Mine Map with Near-Term Exploration Targets (Graphic: Business Wire)

Summary highlights from Kensington’s technical report include:

- A 13% increase in expected average annual payable production to approximately 130,000 ounces of gold from 2019 through 2021 compared to payable production in 2017

- 17% increase in anticipated life-of-mine head grade of 0.21 oz/t compared to the 2017 average head grade of 0.18 oz/t

- Anticipated 8% reduction in average costs from $920 in 2017 to $855 per payable ounce

- Average annual pre-tax cash flows of over $30 million over the three-year period, up from $1.4 million of pre-tax cash flow in 2017

- An extension of mine life from 2020 to 2022 based on current reserves

- Mining rates at the high-grade Jualin deposit expected to ramp up to 100 tons per day in 2019 and average over 180 tons per day in 2020

- 84% increase in expected life-of-mine pre-tax cash flows to $90 million compared to $49 million in Kensington’s 2014 technical report

- Addition of 713,000 ounces of measured and indicated resources and 305,000 ounces of inferred resources, conveying potential for further mine life extensions

“The results of Kensington’s technical report illustrate the significant impact a relatively small amount of high-grade mill feed can have on this mine’s prospects,” said Mitchell J. Krebs, Coeur’s President and Chief Executive Officer. “Once we complete dewatering efforts at Jualin, we plan to ramp up mining rates beginning in the fourth quarter.

“This initial reserve declaration at Jualin represents an important milestone, and we continue to work towards defining Kensington’s greater potential. Our exploration team has identified numerous high-grade, historically-producing veins that are drill-ready, close to existing infrastructure, and we intend to explore their potential to serve as supplemental sources of high-margin production. Like Jualin and Raven, these targets have the potential to drive value at Kensington for many years to come.”

The Kensington district once hosted several past producing mines and prospects, which are located on the figure below, illustrating a lengthy mineralization corridor. The Company intends to explore these historic vein structures over the next 18 months to determine their potential to provide high-grade mill feed, both supplementing feed from Raven and Jualin as well as succeeding them in the longer-term. Surface mapping and sampling of these historic veins have demonstrated encouraging results. Coeur’s exploration team on-site will endeavor to drill test several of these targets for continuity at depth.

2017 Year-End Proven and Probable Reserves

| Short tons | Gold Grade (oz/t) | Contained Gold (oz) | ||||||

| PROVEN RESERVES | Kensington | 1,271,200 | 0.20 | 251,800 | ||||

| Raven | 13,500 | 0.23 | 3,100 | |||||

| Total | 1,284,700 | 0.20 | 254,900 | |||||

| PROBABLE RESERVES | Kensington | 1,499,600 | 0.19 | 286,700 | ||||

| Raven | 19,200 | 0.26 | 5,000 | |||||

| Jualin | 157,600 | 0.47 | 74,100 | |||||

| Total | 1,676,300 | 0.22 | 365,800 | |||||

| PROVEN AND PROBABLE | Total | 2,961,000 | 0.21 | 620,700 | ||||

2017 Year-End Measured and Indicated Resources

| Short tons | Gold Grade (oz/t) | Contained Gold (oz) | ||||||

| MEASURED RESOURCES | Kensington | 1,480,300 | 0.25 | 374,100 | ||||

| Raven | 66,000 | 0.32 | 20,900 | |||||

| Total | 1,546,300 | 0.26 | 395,000 | |||||

| INDICATED RESOURCES | Kensington | 1,146,000 | 0.25 | 287,100 | ||||

| Raven | 14,700 | 0.22 | 3,200 | |||||

| Jualin | 36,800 | 0.74 | 27,200 | |||||

| Total | 1,197,500 | 0.27 | 317,600 | |||||

| MEASURED AND INDICATED | Total | 2,743,800 |

0.26 |

712,600 | ||||

2017 Year-End Inferred Resources

| Short tons | Gold Grade (oz/t) | Contained Gold (oz) | ||||||

| INFERRED RESOURCES | Kensington | 1,244,800 | 0.22 | 272,400 | ||||

| Raven | 134,400 | 0.20 | 27,500 | |||||

| Jualin | 8,600 | 0.58 | 5,000 | |||||

| INFERRED RESOURCES | Total | 1,387,800 | 0.22 | 304,800 |

|

Notes to above mineral reserves and resources (effective December 31, 2017): |

||

| 1. | Assumed metal price for estimated Mineral Reserves was $1,250 per ounce of gold. | |

| 2. | Assumed metal price for estimated Mineral Resources was $1,400 per ounce of gold. | |

| 3. | Mineral Reserves are estimated using a cut-off grade between 0.036 and 0.146 oz./ton gold depending on deposit. Mineral Resources are estimated using a cut-off grade of 0.129 oz./ton gold. | |

| 4. | Mineral Resources are in addition to Mineral Reserves and do not have demonstrated economic viability. Inferred Mineral Resources are considered too speculative geologically to have the economic considerations applied to them that would enable them to be considered for estimation of Mineral Reserves, and there is no certainty that the Inferred Mineral Resources will be realized. | |

| 5. | Rounding of tons and ounces, as required by reporting guidelines, may result in apparent differences between tons, grade, and contained metal content. | |

|

6. |

For details on the estimation of mineral resources and reserves, including the key assumptions, parameters and methods used to estimate the Mineral Resources and Mineral Reserves, Canadian investors should refer to the NI 43-101 Technical Reports for Kensington on file at www.sedar.com. |

|

Comparison of the 2015 and 2018 Technical Reports’ Life of Mine (“LOM”) Economic Analyses

| February 2015 Technical Report | April 2018 Technical Report | |||||

| Estimated Mine Life | 2020 | 2022 | ||||

| Production | ||||||

| Mill throughput | tons (000s) | 3,403,000 | 2,960,973 | |||

| Head grade | oz/t Au | 0.18 | 0.21 | |||

| Contained metal | oz Au | 627,943 | 620,707 | |||

| Overall recovery | % | 93% | 93% | |||

| Payable metal | oz Au | 599,689 | 577,955 | |||

| REVENUE | ||||||

| Gold price | $/oz | $1,275 | $1,250 | |||

| Gross revenue | $M |

$765 |

$722 |

|||

| Refining cost | $M |

($35) |

($20) |

|||

| Net revenue | $M |

$730 |

$702 |

|||

| OPERATING COSTS | ||||||

| Mining | $M | ($290) | ($262) | |||

| Processing | $M | ($127) | ($118) | |||

| General and administrative | $M | ($109) | ($109) | |||

| Royalty | $M | ($6) | ($5) | |||

| Corporate charges | $M | ($35) |

$- |

|||

| Total operating cost | $M |

($566) |

($494) | |||

| Cost per payable gold ounce | $/oz |

$944 |

$855 |

|||

| CASH FLOW | ||||||

| Operating cash flow | $M | $164 | $209 | |||

| Capital expenditures | $M | ($103) | ($97) | |||

| Reclamation | $M | ($11) | ($22) | |||

| Total pre-tax cash flow | $M | $49 | $90 |

|

Notes to the above economic analyses: |

||

| a. | April 2018 Technical Report is effective December 31, 2017 and the February 2015 Technical Report is effective December 31, 2014. | |

| b. | Rounding of tons and ounces, as required by reporting guidelines, may result in apparent differences between tons, grade, and contained metal content. | |

| c. |

For details on the estimation of mineral reserves, mineral resources, and inferred mineral resources, including the key assumptions, parameters and methods used to estimate the Mineral Reserves, Mineral Resources, and Inferred Mineral Resources, Canadian investors should refer to the applicable NI 43-101 Technical Report for Kensington on file at www.sedar.com. |

|

About Coeur

Coeur Mining, Inc. is a well-diversified, growing precious metals producer with five mines in North America. Coeur produces from its wholly-owned operations: the Palmarejo silver-gold complex in Mexico, the Silvertip silver-zinc-lead mine in British Columbia, the Rochester silver-gold mine in Nevada, the Kensington gold mine in Alaska, and the Wharf gold mine in South Dakota. In addition, the Company has interests in several precious metals exploration projects throughout North America.

Cautionary Statements

This news release contains forward-looking statements within the meaning of securities legislation in the United States and Canada, including statements regarding the anticipated installation of dewatering pumps at Jualin and production ramp-up, exploration efforts and value creation, as well as anticipated financial and operating results, including production, mining rates, capital expenditures, recoveries, costs, revenues, asset values, margins, cash flows, and mine life. Such forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause Coeur's actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Such factors include, among others, the risk that the expected financial and operating results for Kensington are not achieved on a timely basis or at all, the risks and hazards inherent in the mining business (including risks inherent in developing large-scale mining projects, environmental hazards, industrial accidents, weather or geologically related conditions), changes in the market prices of gold and silver and a sustained lower price environment, the uncertainties inherent in Coeur's production, exploratory and developmental activities, including risks relating to permitting and regulatory delays, ground conditions, grade variability, any future labor disputes or work stoppages, the uncertainties inherent in the estimation of gold and silver reserves, changes that could result from Coeur's future acquisition of new mining properties or businesses, the loss of any third-party smelter to which Coeur markets silver and gold, the effects of environmental and other governmental regulations, the risks inherent in the ownership or operation of or investment in mining properties or businesses in foreign countries, Coeur's ability to raise additional financing necessary to conduct its business, make payments or refinance its debt, as well as other uncertainties and risk factors set out in filings made from time to time with the United States Securities and Exchange Commission, and the Canadian securities regulators, including, without limitation, Coeur's most recent reports on Form 10-K and Form 10-Q. Actual results, developments and timetables could vary significantly from the estimates presented. Readers are cautioned not to put undue reliance on forward-looking statements. Coeur disclaims any intent or obligation to update publicly such forward-looking statements, whether as a result of new information, future events or otherwise. Additionally, Coeur undertakes no obligation to comment on analyses, expectations or statements made by third parties in respect of Coeur, its financial or operating results or its securities.

Christopher Pascoe, Coeur's Director, Technical Services and a qualified person under Canadian National Instrument 43‐101, reviewed and approved the scientific and technical information concerning Coeur's mineral projects in this news release. Mineral resources are in addition to mineral reserves and do not have demonstrated economic viability. Inferred mineral resources are considered too speculative geologically to have the economic considerations applied to them that would enable them to be considered for estimation of mineral reserves, and there is no certainty that the inferred mineral resources will be realized. For a description of the key assumptions, parameters and methods used to estimate mineral reserves and resources, as well as data verification procedures and a general discussion of the extent to which the estimates may be affected by any known environmental, permitting, legal, title, taxation, socio‐political, marketing or other relevant factors, Canadian investors should refer to the NI 43-101 Technical Report for Kensington filed April 25, 2018 on SEDAR at www.sedar.com.

Cautionary Note to U.S. Investors ‐ The United States Securities and Exchange Commission permits U.S. mining companies, in their filings with the SEC, to disclose only those mineral deposits that a company can economically and legally extract or produce. We may use certain terms in public disclosures, such as "measured," "indicated," "inferred” and “resources," that are recognized by Canadian regulations, but that SEC guidelines generally prohibit U.S. registered companies from including in their filings with the SEC. U.S. investors are urged to consider closely the disclosure in our Form 10‐K which may be secured from us, or from the SEC's website at http://www.sec.gov.

|

Conversion Table |

||||

| 1 short ton | = | 0.907185 metric tons | ||

| 1 troy ounce | = | 31.10348 grams | ||

View source version on businesswire.com: https://www.businesswire.com/news/home/20180425006688/en/