SAN FRANCISCO--(BUSINESS WIRE)--

Wells Fargo & Company (NYSE:WFC) announced today the company is launching a pilot to test an artificial intelligence (AI)-driven customer chat experience for Facebook Messenger.

This Smart News Release features multimedia. View the full release here: http://www.businesswire.com/news/home/20170418006490/en/

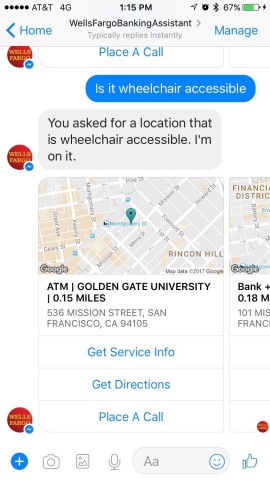

Wells Fargo is piloting an artificial intelligence (AI)-driven customer chat experience for Facebook Messenger, which will help answer common questions. (Photo: Business Wire)

Wells Fargo’s bot for Messenger is a pilot test and is part of the company’s innovation agenda, which focuses on incorporating financial services into third-party environments to meet customers where they are and into the moments they want to use them. Initially, the pilot has been opened to several hundred Wells Fargo team members. Later this spring, Wells Fargo plans to invite a few thousand customers to participate as the bank expands the testing environment.

“We’re very excited about the opportunity to provide more personalized services for customers, and to bring those services directly to our customers,” said Steve Ellis, head of Wells Fargo’s Innovation Group, where the company’s Artificial Intelligence Enterprise Solutions team is based. “Our goal is to deliver information ‘in the moment’ to help customers make better informed financial decisions. AI technology allows us to take an experience that would have required our customers to navigate through several pages on our website, and turn it into a simple conversation in a chat environment. That’s a huge time-saving convenience for busy customers who are already frequent users of Messenger.”

Wells Fargo has been providing assistance to its customers in Facebook platforms since 2009.

In May 2016, the bank adopted Messenger as its main channel for addressing customers’ common questions and service issues. The majority of Wells Fargo’s customer engagements are now conducted on Messenger, rather than its public Facebook News Feed, and the company estimates that millions of Wells Fargo customers regularly use Messenger to communicate with friends and family.

Regardless of how a customer chooses to do business with Wells Fargo, innovation and technology will help the company deliver an outstanding customer experience, build trust, and give more information to customers to help them make decisions about their finances. As outlined in February, artificial intelligence will be an area of focus for the San Francisco-based bank’s Payments, Virtual Solutions and Innovation (PVSI) group, as it sees an increasing number of opportunities to better leverage data to provide personalized customer service through its bankers and digital channels.

About Wells Fargo

Wells Fargo & Company (NYSE: WFC) is a diversified, community-based financial services company with $1.9 trillion in assets. Founded in 1852 and headquartered in San Francisco, Wells Fargo provides banking, insurance, investments, mortgage, and consumer and commercial finance through more than 8,600 locations, 13,000 ATMs, the internet (wellsfargo.com) and mobile banking, and has offices in 42 countries and territories to support customers who conduct business in the global economy. With approximately 269,000 team members, Wells Fargo serves one in three households in the United States. Wells Fargo & Company was ranked No. 27 on Fortune’s 2016 rankings of America’s largest corporations. Wells Fargo’s vision is to satisfy our customers’ financial needs and help them succeed financially. News, insights and perspectives from Wells Fargo are also available at Wells Fargo Stories.

View source version on businesswire.com: http://www.businesswire.com/news/home/20170418006490/en/