RIVERWOODS, Ill.--(BUSINESS WIRE)--

The holiday season is synonymous with shopping, or in other words, putting a snowball-sized dent in your wallet. The good news? According to Discover’s annual holiday shopping survey, many consumers plan to turn some of their holiday shopping into cashback and other rewards.

This Smart News Release features multimedia. View the full release here: http://www.businesswire.com/news/home/20161115005420/en/

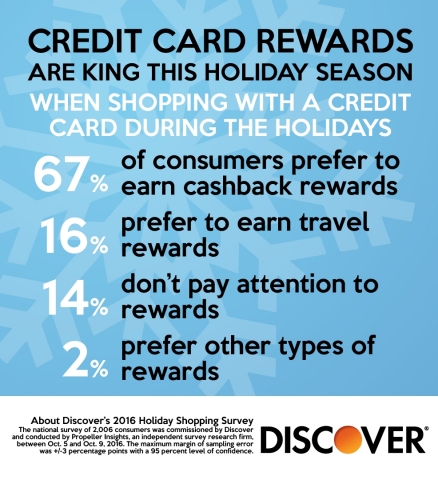

When it comes to converting credit card rewards, 67% of consumers say they prefer to earn cashback during the holidays, while 16% prefer to earn travel rewards. (Graphic: Business Wire)

The survey found that consumers plan to spend an average of $1,159 this holiday season, with much of the holiday tab being charged to their credit cards. Thirty-eight percent of those surveyed say they’ll use a credit card for most of their holiday purchases, making credit cards the most popular form of payment during the holidays. That’s followed by 28 percent who say they’ll mostly use a debit card, 19 percent who say they’ll pay cash for most purchases and 8 percent who will favor redeeming gifts cards or rewards/points.

Of those who plan to use a credit card for most of their holiday shopping, 46 percent say their biggest reason for doing so is to earn rewards. That’s compared to 27 percent who cite convenience, 16 percent who cite the ability to track their spending and 11 percent who say they won’t have enough cash on hand.

Among credit card users, 33 percent say they focus on earning rewards while holiday shopping, compared to 10 percent who say they focus on redeeming rewards. Thirty percent say they are equally focused on earning and redeeming rewards.

When it comes to converting credit card rewards, 67 percent say they prefer to earn cashback during the holidays, while 16 percent prefer to earn travel rewards.

More Consumers Plan to Surf the Web than Roam the Aisles

Forty-three percent of those surveyed say they plan to do most of their holiday shopping online this year, compared to 32 percent who will favor shopping in stores.

A growing number of consumers, 58 percent, plan to use a mobile device—a smartphone or tablet—to shop for gifts this holiday season, up from 47 percent last year. Of those who plan to shop on their smartphone or tablet, 77 percent say they’ll do about half or more of their holiday shopping on their mobile device.

The trend toward mobile holiday shopping is being led by those 35 and older, who are planning to shop on a mobile device this year at a rate 15 percent higher than last year. By comparison, millennials, those between the ages of 18 and 34, will do so at a rate just 4 percent higher than last year.

Another way consumers plan to use their mobile devices this holiday season is to conduct price comparisons. More than half of those surveyed, 55 percent, say they plan to use their smartphone or tablet to compare prices online while shopping in a physical store. That number jumps to 72 percent among millennial shoppers.

When survey respondents were asked about their feelings toward shopping online versus in-store during the holidays, online shopping won out in terms of being more convenient, less stressful and having better prices, whereas in-store shopping scored better for being more fun, more satisfying and more secure. The breakdown is as follows:

| Best describes online shopping | Best describes in-store shopping | |||||

| More convenient | 80% | 20% | ||||

| More fun | 44% | 56% | ||||

| More stressful | 17% | 83% | ||||

| Better prices | 77% | 23% | ||||

| More satisfying | 46% | 54% | ||||

| More secure | 29% | 71% | ||||

Consumers Value Security over Speed at Checkout

Consumers were split over whether or not they think chip cards will be a drag at the checkout counter this holiday season. Among those surveyed, 42 percent think chip cards will make the in-store checkout process take longer during the holidays, while 40 percent think they won’t. However, when asked which was more important to them, the security of their payment and personal information, or speed during checkout, 51 percent chose security and 7 percent chose speed. Forty-three percent said the two were equally important.

About Discover’s 2016 Holiday Shopping Survey

The national survey of 2,006 consumers was commissioned by Discover and conducted by Propeller Insights, an independent survey research firm, between Oct. 5 and Oct. 9, 2016. The maximum margin of sampling error was ±3 percentage points with a 95 percent level of confidence.

About Discover

Discover Financial Services (NYSE: DFS) is a direct banking and payment services company with one of the most recognized brands in U.S. financial services. Since its inception in 1986, the company has become one of the largest card issuers in the United States. The company issues the Discover card, America's cash rewards pioneer, and offers private student loans, personal loans, home equity loans, checking and savings accounts and certificates of deposit through its direct banking business. It operates the Discover Network, with millions of merchant and cash access locations; PULSE, one of the nation's leading ATM/debit networks; and Diners Club International, a global payments network with acceptance in more than 185 countries and territories. For more information, visit www.discover.com/company.

View source version on businesswire.com: http://www.businesswire.com/news/home/20161115005420/en/