Gold to Silver Ratio: Turning Lower

Gold to Silver Ratio: Turning Lower

Gold to Silver ratio looks to have ended cycle from 7/4/2016 low (64.38) and should turn lower at least in 3 waves to correct cycle from 7/4/2016 low. The video below explains what the expected turn lower in the ratio means to Gold and Silver:

Video Player00:00

07:09

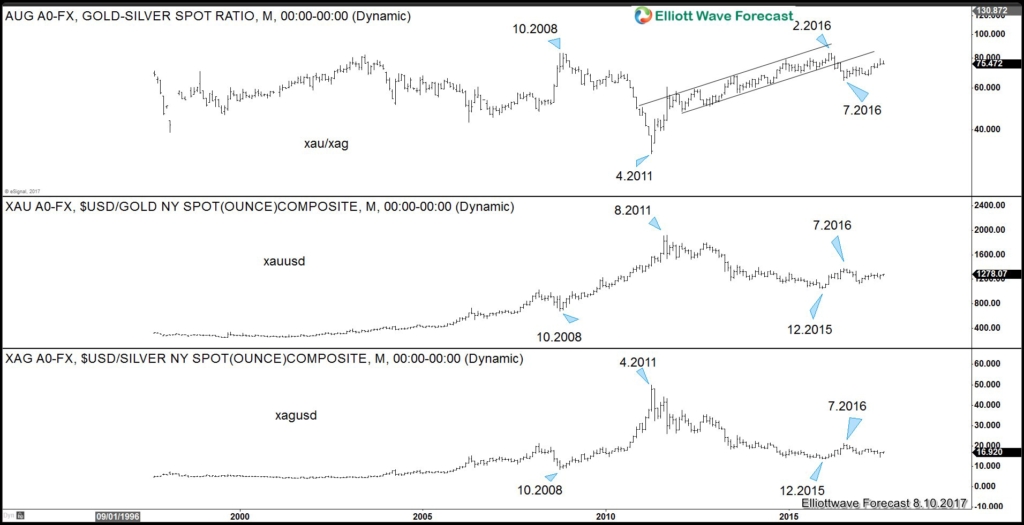

Gold to Silver Ratio Correlation Chart

Overlay of Gold-to-Silver ratio chart together with Gold (XAUUSD) and Silver (XAGUSD) chart above shows an inverse correlation. When the ratio fell down such as in the period between 10.2008 – 4.2011, both Gold and Silver price rallied. Conversely, when the ratio rallied like in the period between 4.2011 – 2.2016, both Gold and Silver price fell down. A case can be made that we could see the ratio falls again after breaking below the ascending channel, and this should support both Gold and Silver in coming months.

Gold to Silver Ratio Daily Chart

Gold-to-Silver ratio is correcting cycle from 2/29/2016 peak (83.68) and looks to have ended with wave (X) at 79.257. While bounces stay below there, expect the ratio to move lower to at least correct cycle from 2/29/2016 low in larger 3 waves if not resuming the decline from 2/29/2016 peak. Expect both Gold and Silver to be supported in coming months when the ratio finally turns lower.

If you like this analysis, take our 14 days FREE trial by clicking here –> risk free trial and see the next path for XAUUSD, XAGUSD, and other instrument in 4 time frames, live session, live trading room, 24 hour chat room, and much more.

Elliottwave-Forecast.com (by EME PROCESSING AND CONSULTING LLC) was founded in 2005 by Eric Morera. Since inception our company has provided tailored Financial Market Services to thousands of clients. ElliottWave-Forecast has built a reputation on accurate technical analysis and a winning attitude. By successfully incorporating the Elliott Wave Theory with Market Correlation, Cycles, Proprietary Pivot System, we provide precise forecasts with up-to-date analysis for 52 instruments including FX majors, Gold, Silver, Copper, Oil, TNX and major Equity Indices. Our clients also have immediate access to our proprietary Actionable Trade Setups, Market Overview, 1 Hour, 4 Hour, Daily & Weekly Wave Counts. Weekend Webinar, Live Screen Sharing Sessions, Daily Technical Videos, Educational Resources, and 24 Hour chat room where they are provided live updates and given answers to their questions.

Unfortunately, this report is not available for the investor type or country you selected.

Browse all ResearchPool reportsReport is subscription only.

Thank you, your report is ready.

Thank you, your report is ready.