Amazon (AMZN) Short Term Correction

Amazon is one of the fewest company that kept a strong portfolio during the recent decades even after 2 stock market crises . The company issued its initial public offering of stock on 1997, trading under the NASDAQ stock exchange symbol AMZN, at a price of $1.50 per share and since then the price just kept rising year over year providing the best return for its investors .

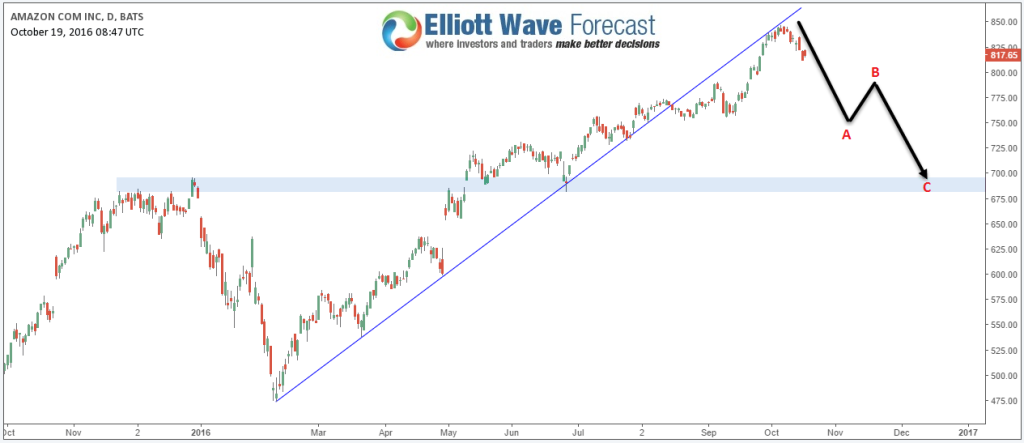

After almost 20 years , Amazon is still rising and making new all time highs . Recently on the 6th of last October the stock made another high at $847.21 retesting the broken trend-line from February low then starting a pullback from there . The stock was expected to resume higher as usual but the pivot at September low gave up indicating that the stock was looking for a deeper 3 wave pullback before buyers could step up once again.

Looking at the current daily chart of AMZN , the stock is correcting the rally from Fabruary low looking to reach 50% – 74.6% Fibonacci area at ( $660.6 – $568.8 ) to end 3 waves from $847.2 peak . Currently it’s ending the first leg A of the correction and it’s expected to bounce in wave B against October peak before doing another leg to the downside . The correction doesn’t necessary have to be a Zigzag ( ABC ) it could switch depending on the coming structure but what’s more important is that the main trend for the Amazon remain bullish and any correction in 3 , 7 or 11 swings should provide an opportunity to buy it either for new highs or at least a larger bounce .

For further information on how to find levels to trade forex, indices, and stocks using Elliott Wave and the 3 , 7 or 11 swings technique, try us free for 14 days. You will get access to Professional Elliott Wave analysis in 4 different time frames, Daily Elliott Wave Setup Videos , Live Trading Room and 2 live Analysis Session done by our Expert Analysts every day, 24 hour chat room support, market overview, weekly technical videos and much more so if you are not a member yet, use this opportunity and sign up to get your free trial . If you enjoyed this article, feel free to read other diversified articles at our Technical Blogs and also check Chart of The Day .

Elliottwave-Forecast.com (by EME PROCESSING AND CONSULTING LLC) was founded in 2005 by Eric Morera. Since inception our company has provided tailored Financial Market Services to thousands of clients. ElliottWave-Forecast has built a reputation on accurate technical analysis and a winning attitude. By successfully incorporating the Elliott Wave Theory with Market Correlation, Cycles, Proprietary Pivot System, we provide precise forecasts with up-to-date analysis for 52 instruments including FX majors, Gold, Silver, Copper, Oil, TNX and major Equity Indices. Our clients also have immediate access to our proprietary Actionable Trade Setups, Market Overview, 1 Hour, 4 Hour, Daily & Weekly Wave Counts. Weekend Webinar, Live Screen Sharing Sessions, Daily Technical Videos, Educational Resources, and 24 Hour chat room where they are provided live updates and given answers to their questions.

Unfortunately, this report is not available for the investor type or country you selected.

Browse all ResearchPool reportsReport is subscription only.

Thank you, your report is ready.

Thank you, your report is ready.