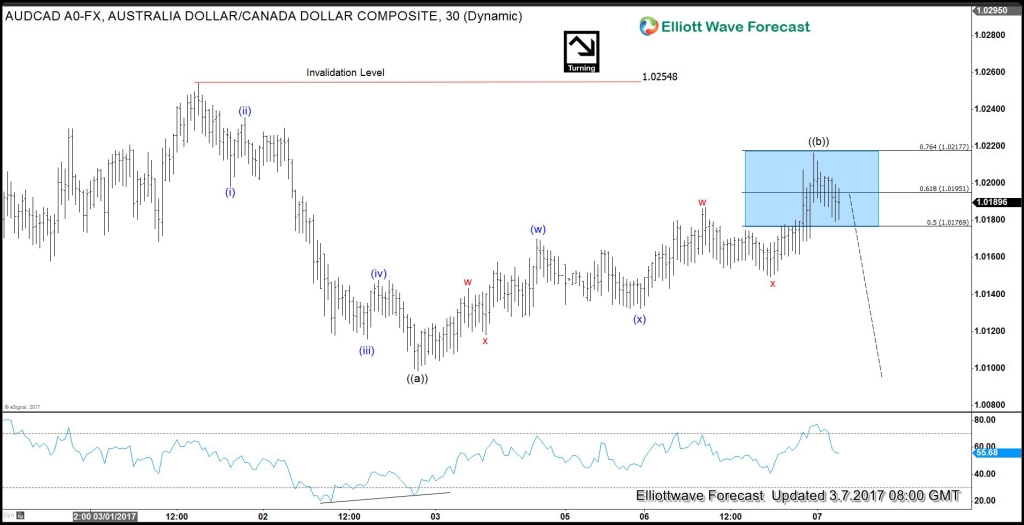

AUDCAD Elliottwave Intraday View

Short term Elliottwave structure of AUDCAD from 3/1 peak (1.025) looks to be showing an impulse structure with a nice 5 waves subdivision where Minuette wave (i) ended at 1.0198, Minuette wave (ii) ended at 1.0235, Minuette wave (iii) ended at 1.0115, Minuette wave (iv) ended at 1.0147, and Minuette wave (v) ended at 1.0098. We can also see momentum divergence at the end of wave (v) as shown by the RSI making lower high while price makes lower low. This 5 waves down form a higher degree Minute wave ((a)) of a zigzag structure. The 5 waves move from 1.025 high doesn’t look to be part of wave C of a FLAT in higher degree structure, which implies that while AUDCAD stays below 1.025, we can see another leg lower in the pair in wave ((c)) to end the zigzag structure. Potential target for wave ((c)) is towards 1.0025 – 1.006 area and from this area we can see buyers returning in the market to push prices to a new high above 1.02548 or for a 3 wave bounce at least.

AUDCAD 1 Hour Chart

If not a member yet, Join us and take advantage of the 50% off special offer now and get new trading opportunities. Through time we have developed a very respectable trading strategy which defines Entry, Stop Loss and Take Profit levels with high accuracy. If you want to learn all about it and become a professional Trader. Elliott Wave Forecast keeps you on right side of the market. We provide Elliott Wave charts in 4 different time frames. 3 live sessions by our expert analysts every day. 24 hour chat room moderated by our expert analysts and much more! Welcome to EWF !

Elliottwave-Forecast.com (by EME PROCESSING AND CONSULTING LLC) was founded in 2005 by Eric Morera. Since inception our company has provided tailored Financial Market Services to thousands of clients. ElliottWave-Forecast has built a reputation on accurate technical analysis and a winning attitude. By successfully incorporating the Elliott Wave Theory with Market Correlation, Cycles, Proprietary Pivot System, we provide precise forecasts with up-to-date analysis for 52 instruments including FX majors, Gold, Silver, Copper, Oil, TNX and major Equity Indices. Our clients also have immediate access to our proprietary Actionable Trade Setups, Market Overview, 1 Hour, 4 Hour, Daily & Weekly Wave Counts. Weekend Webinar, Live Screen Sharing Sessions, Daily Technical Videos, Educational Resources, and 24 Hour chat room where they are provided live updates and given answers to their questions.

Unfortunately, this report is not available for the investor type or country you selected.

Browse all ResearchPool reportsReport is subscription only.

Thank you, your report is ready.

Thank you, your report is ready.