CVR Energy Bullish Reversal ( CVI )

CVR Energy Presentation & News

CVR Energy ( NYSE:CVI ) is a diversified holding company primarily engaged in the petroleum refining and nitrogen fertilizer manufacturing industries through its holdings in two limited partnerships, CVR Refining ( NYSE:CVRR ) and CVR Partners ( NYSE:UAN ).

The largest shareholder of CVR Energy is Carl Icahn, who, through Icahn Enterprises, owns 82% of shares and being named by the new elected President Donald Trump as his Special Adviser on Regulatory Reform . The activist investor Carl ,who is the 26th richest man on the planet according to Forbes, clearly fits the roll as Trump was looking for “people that made a fortune†and he’s also a his business partner .

Wall Street is probably referring to this news as the reason for the +100% rise of CVR Energy since last month low because small-cap stocks, such as CVI, are popular for their explosive growth and sensitive to geopolitical changes . So the recent decision made by OPEC & other countries to cut OIL production for the first time in 8 years will have a big influence on the company’s stock in the future .

Elliott Wave Technical Analysis

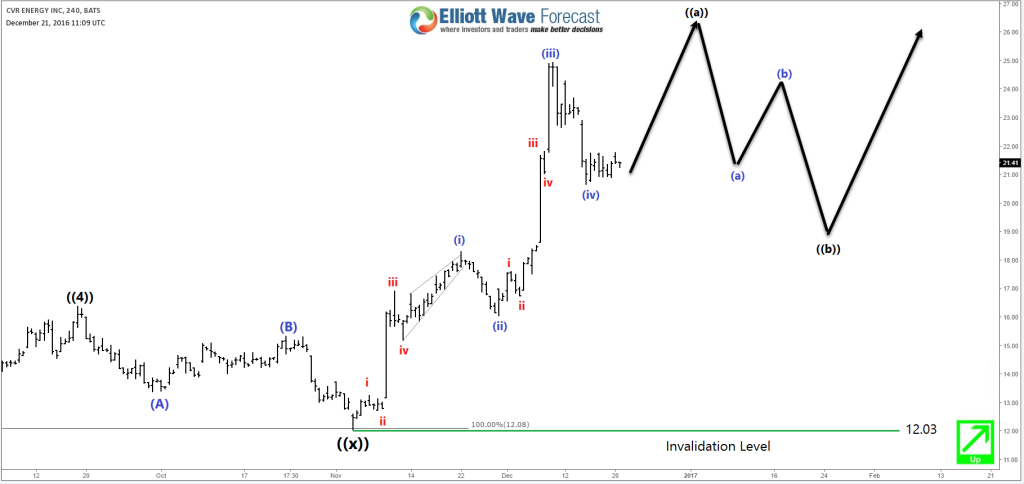

CVI saw a 83.3% decline since 2013 peak in which it corrected the rally from 2008 low in 3 big swings ( WXY ) that looks to have ended in 2nd November 2016 after it reached the equal legs area $12.08 . So if wave ((x)) is done then the stock is ready to resume its rally for new all time highs above $80 or at least do a 3 waves bounce toward the 50% – 61.8% Fibonacci area around ( $42 – $49 ) . This move is supported by the fact that the company partners stocks UAN & CVRR have enough number of swings to call cycles from 2012 & 2013 peaks completed and start bouncing higher .

Looking closer at the shorter term cycles , CVI is proposed to be doing a 5 waves impulsive move from 11/02 low and currently still needs 1 more leg higher before it can end that cycle and start pulling back in 3 waves which can represent an opportunity to buy the stock later on next year. If CVI fails to break the previous peak then November cycle has already ended as 3 waves Zigzag move ( ABC ) and the stock will be looking to finish 7 swings lower as a double against $12.03 low before resuming higher.

Recap

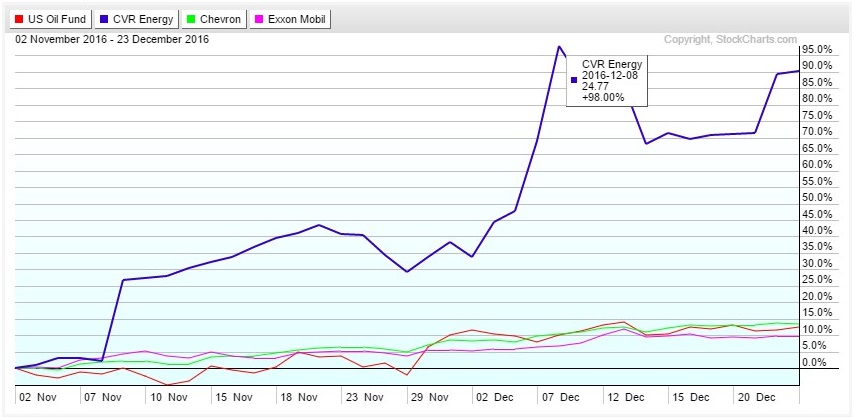

In the recent surge higher CVI clearly outperformed OIL & its related stocks like Exxon Mobile ( XOM ) and Chevron ( CVX ) which saw a double digit rise that didn’t exceed +20% unlike CVI which saw +98% . This amazing performance will attract more investors to buy the stock so I recommend that you add it to your watch-list and wait for the next pullback to happen before you can look for an opportunity to join this bullish reversal .

If you enjoyed this post, feel free to read other articles at our Technical Blog and also check our Chart of The Day . For further information on how to trade forex, indices, commodities and stocks using Elliott Wave technique , try us 14 days for FREE . You will get access to our Professional Elliott Wave analysis in 4 different time frames, Daily Elliott Wave Setup Videos , Live Trading Room and 2 Live Analysis Session done by our Expert Analysts every day, 24 hour chat room support, Weekly Technical videos and much more so if you are not a member yet, use this opportunity and sign up to get your FREE trial .

Elliottwave-Forecast.com (by EME PROCESSING AND CONSULTING LLC) was founded in 2005 by Eric Morera. Since inception our company has provided tailored Financial Market Services to thousands of clients. ElliottWave-Forecast has built a reputation on accurate technical analysis and a winning attitude. By successfully incorporating the Elliott Wave Theory with Market Correlation, Cycles, Proprietary Pivot System, we provide precise forecasts with up-to-date analysis for 52 instruments including FX majors, Gold, Silver, Copper, Oil, TNX and major Equity Indices. Our clients also have immediate access to our proprietary Actionable Trade Setups, Market Overview, 1 Hour, 4 Hour, Daily & Weekly Wave Counts. Weekend Webinar, Live Screen Sharing Sessions, Daily Technical Videos, Educational Resources, and 24 Hour chat room where they are provided live updates and given answers to their questions.

Unfortunately, this report is not available for the investor type or country you selected.

Browse all ResearchPool reportsReport is subscription only.

Thank you, your report is ready.

Thank you, your report is ready.