Trump Reflation Trade

The past decade has seen massive reliance on Monetary Policy by Central Bank to maintain economic momentum, but not enough Fiscal Policy or stimulative government intervention. The election of Donald Trump as the new U.S. president is thought to change that. In his first speech as president-elect, Mr. Trump highlighted investment in infrastructure, reinforcing the shift to fiscal stimulus in 2017. The prospect of expansionary policy – fiscal spending and tax cuts helped calm financial market. There was a rotation out of bonds with global bond markets selling off nearly $2 trillion and 10 year Treasury yield rose 20 bps to 2.35% on expectation that increased US government spending could lead to higher inflation.

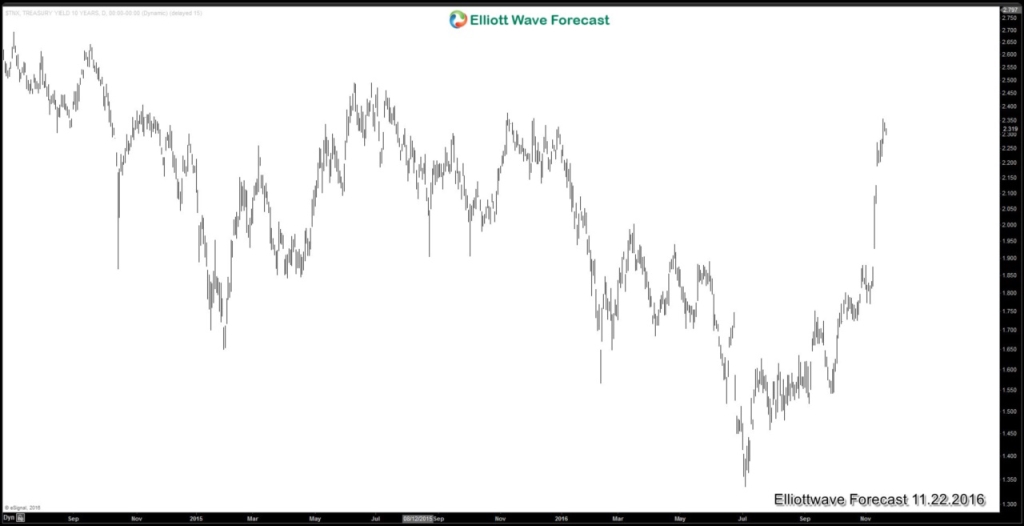

10-year Treasury Yield

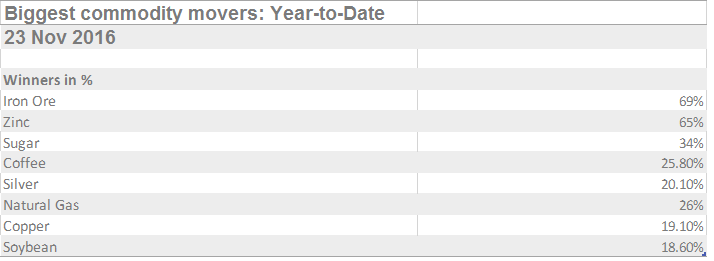

Besides the rising yields, global equity markets also see the inflow of funds. The US equity ETFs took US$34 billion of inflow and American Indices reached all-time highs. In addition, the US$ has strengthened and reached 13 year high, while commodities also rally. Driven by rising PMI across all regions, we also see big move in the commodity sectors this year. Below is a table of some of the biggest commodity mover

On the back of increased domestic infrastructure spending, higher commodity demand and thus higher price is expected in 2017. The main risk for this rally in global commodities is how much of the campaign rhetoric translate into policy reality. Mr. Trump still needs to articulate well defined policies. If Mr. Trump’s fiscal stimulus is not as large as investors anticipate, the inflation trade may suffer a setback.

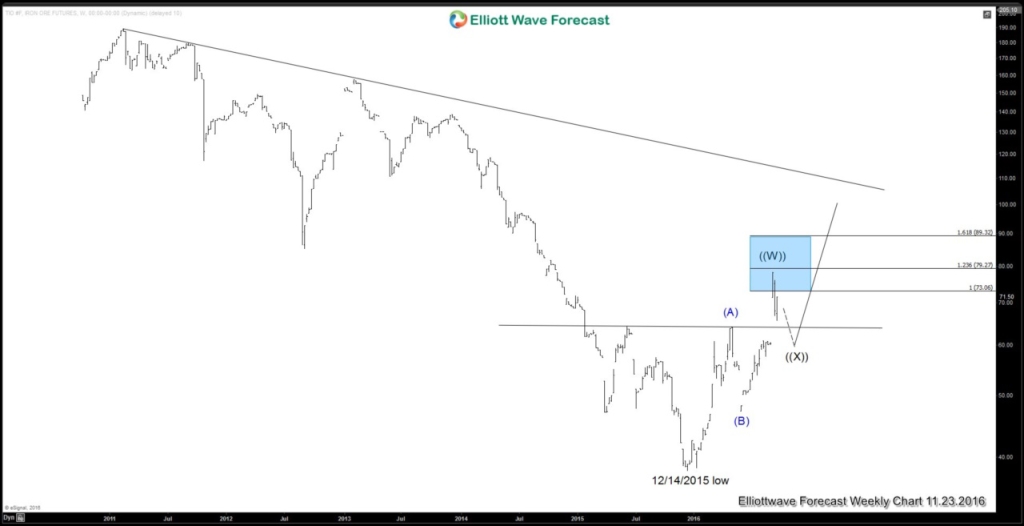

Iron Ore Weekly Chart

Iron Ore Weekly chart above suggests that it has reached the inflection area where cycle from 12/14/2015 low may end and a 3 waves pullback can take place. The chart is also showing a pattern of what looks to be inverse head and shoulder with the neckline already broken. Overall, the pattern favors more upside once the correction is complete, and this is also supported by the fundamental background above.

At EWF, we cover 52 instrument in different asset classes from forex, commodities, and indices. We provide Elliottwave forecast in 4 different time frames, Live Trading Room, 24 hour chat room, live sessions, and much more. Take advantage of the Black Friday Sale promotion this week. Join EWF and get 50% discount on any plan you choose, click the banner below

For free resources, you can check other technical articles at our Technical Blogs and check Chart of The Day.

Elliottwave-Forecast.com (by EME PROCESSING AND CONSULTING LLC) was founded in 2005 by Eric Morera. Since inception our company has provided tailored Financial Market Services to thousands of clients. ElliottWave-Forecast has built a reputation on accurate technical analysis and a winning attitude. By successfully incorporating the Elliott Wave Theory with Market Correlation, Cycles, Proprietary Pivot System, we provide precise forecasts with up-to-date analysis for 52 instruments including FX majors, Gold, Silver, Copper, Oil, TNX and major Equity Indices. Our clients also have immediate access to our proprietary Actionable Trade Setups, Market Overview, 1 Hour, 4 Hour, Daily & Weekly Wave Counts. Weekend Webinar, Live Screen Sharing Sessions, Daily Technical Videos, Educational Resources, and 24 Hour chat room where they are provided live updates and given answers to their questions.

Unfortunately, this report is not available for the investor type or country you selected.

Browse all ResearchPool reportsReport is subscription only.

Thank you, your report is ready.

Thank you, your report is ready.