WXY and ABC Elliott Wave Structure

​In the video below, we explain the wxy Elliott Wave structure, often called a double three, double correction, or 7 swing Elliott Wave structure. We also compare this wxy structure with abc structure, explaining the similarities and differences.

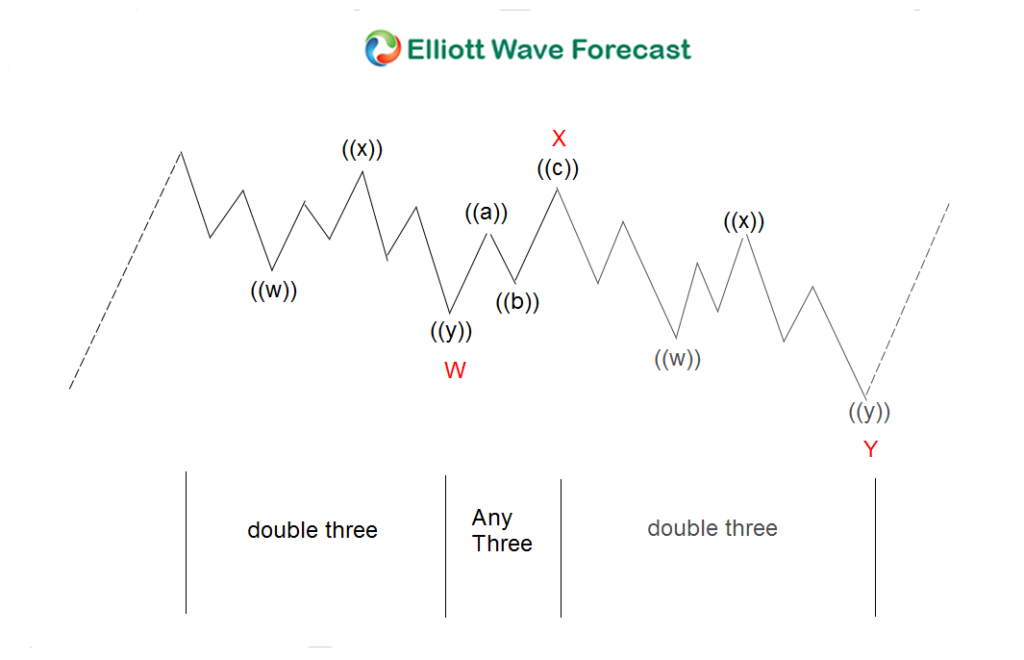

Double Three Eliott Wave Structure (WXY)

A double three structure, or also called a double correction, or WXY is a 3 waves corrective structure where the third leg (wave Y) is usually 100% – 123.6% of the first leg (wave X) and not more than 161.8%. The subdivision of wave W is in 3 waves, and the subdivision of wave Y is also in 3 waves, thus it is a 3-3-3 structure.

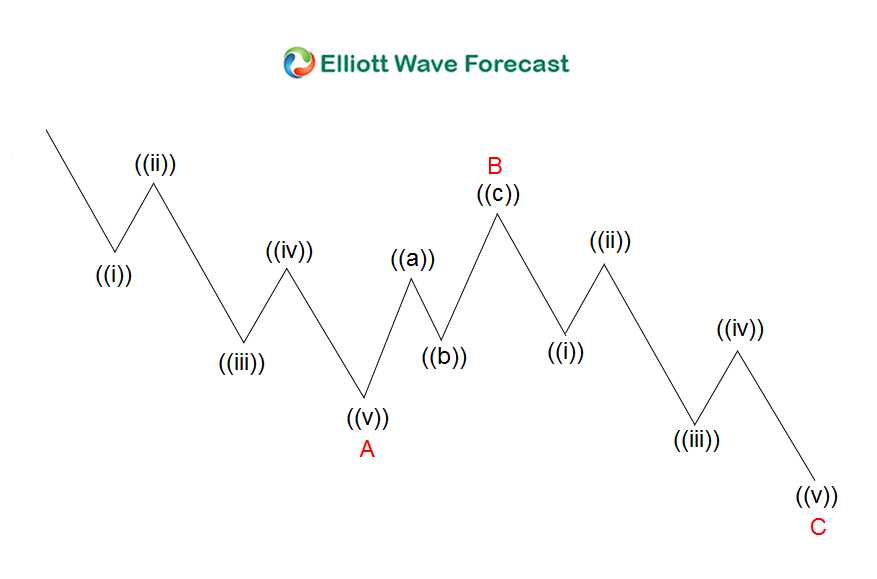

Zig-zag Elliott Wave Structure (ABC)

A zig-zag Elliott Wave structure (ABC) is very similar to WXY. It’s also a 3 waves structure and the third leg (wave C) is usually 100% – 123.6% of the first leg (wave A), and not more than 161.8%. The difference between the two is in the internal subdivision of the first leg and third leg. In ABC, the subdivision of wave A is in 5 waves and the subdivision of wave C is in 5 waves.

Wavers tend to be familiar only with ABC and label every 3 waves move as ABC. In reality, unless the subdivision of the first leg and third leg is in 5 waves, it’s wrong to label every 3 waves move as an ABC. We hope that this video and article helps to clarify the differences and when to label as WXY and when to label as ABC.

If you are interested to learn more about Elliott Wave, how to identify setup using our Elliott Wave sequence technique, and how to execute a trade and control risk, check our Educational classes and bundles (packages) which include consultation with our technical analysts here –> Educational Page

Elliottwave-Forecast.com (by EME PROCESSING AND CONSULTING LLC) was founded in 2005 by Eric Morera. Since inception our company has provided tailored Financial Market Services to thousands of clients. ElliottWave-Forecast has built a reputation on accurate technical analysis and a winning attitude. By successfully incorporating the Elliott Wave Theory with Market Correlation, Cycles, Proprietary Pivot System, we provide precise forecasts with up-to-date analysis for 52 instruments including FX majors, Gold, Silver, Copper, Oil, TNX and major Equity Indices. Our clients also have immediate access to our proprietary Actionable Trade Setups, Market Overview, 1 Hour, 4 Hour, Daily & Weekly Wave Counts. Weekend Webinar, Live Screen Sharing Sessions, Daily Technical Videos, Educational Resources, and 24 Hour chat room where they are provided live updates and given answers to their questions.

Unfortunately, this report is not available for the investor type or country you selected.

Browse all ResearchPool reportsReport is subscription only.

Thank you, your report is ready.

Thank you, your report is ready.