HONG KONG--(BUSINESS WIRE)--

A select group of leading-edge financial services technology (fintech) companies demonstrated their products and services to dozens of top bank, venture capital and technology executives today at the third annual FinTech Innovation Lab Asia-Pacific Investor Day.

This Smart News Release features multimedia. View the full release here: http://www.businesswire.com/news/home/20161108005009/en/

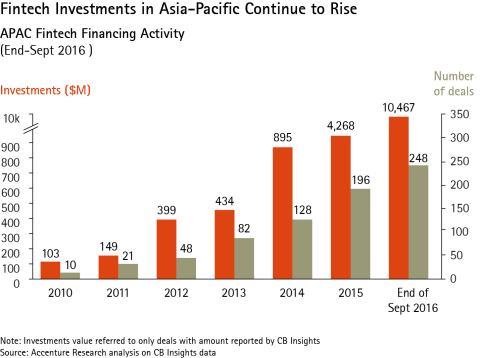

APAC Fintech Financing Activities (Graphic: Business Wire)

Launched by Accenture (NYSE:ACN) in June 2014, the FinTech Innovation Lab is a 12-week mentoring program to enhance fintech innovation and drive high-tech job growth in Asia-Pacific by connecting startups with decision makers at some of the world’s leading financial institutions. This year’s Investor Day was held at Cyberport in Hong Kong.

“Investor Day is always an exciting event in Hong Kong as it underscores best practice: the financial services industry working together with Accenture and the government to nurture startups that offer innovative solutions to challenges facing the industry,” said Nicholas Yang, the Secretary for Innovation and Technology of the Hong Kong Special Administrative Region. “We are pleased to be spearheading this cooperative mentorship at a time when fintech is on the rise across Asia-Pacific.”

In the first three quarters of 2016, fintech investments in Asia-Pacific reached nearly $10.5 billion, the bulk of it driven by investments involving Greater China companies. This is more than Europe, which attracted $2 billion in investments, and more than the US, which attracted $6 billion in investments in the same period.

“We are increasingly seeing a willingness from financial institutions in the region to work with fintech startups to help address new challenges ranging from how best to adopt blockchain technology to how to maximize IT efficiency,” said Jon Allaway, senior managing director, Financial Services at Accenture, and the executive sponsor of the FinTech Innovation Lab Asia-Pacific. “The startups that we are seeing typically have banking experience and understand the perspective of the banks or are passionate about a customer experience that they believe needs to be fixed, but it’s their enthusiasm and laser-sharp focus on a specific area that gives them deep-dive expertise that makes them so valuable to financial services companies.”

The eight companies in this year’s lab were selected by senior technology executives from participating financial institutions and have spent the past 12 weeks receiving intensive mentoring, product and business-development advice, and exposure to senior financial industry, technology and venture capital executives. The twelve principal financial institutions are: Bank of America Merrill Lynch, BNP Paribas, Commonwealth Bank of Australia, Credit Suisse, Generali, Goldman Sachs, HSBC, J.P. Morgan, Maybank, Morgan Stanley, Sun Life Financial and UBS. In addition, supporting banks include: China CITIC Bank International, China Construction Bank (Asia), Macquarie, Nomura, Standard Chartered, Siam Commercial Bank, Societe Generale, Sumitomo Mitsui Financial Group (SMFG).

The startups have developed a range of innovations – from wealth management solutions that are precisely oriented to customers’ investment intents, know your customer (KYC) services that leverage blockchain technology and a fraud prevention program using algorithms based in Chinese-characters to help financial institutions flag risk. They include:

- ChartIQ – provides securities-specific financial chart and data visualization products in HTML5. The Charlottesville, Virginia-based startup, which has offices in New York, London, and Cyprus, has more than 125 customers around the world. Its time-series based charting solutions provide charting and data visualization that can help investment banks, brokerages, trading platforms, and financial portals move from legacy technologies to the future of HTML5.

- HedgeSPA – is a predictive investment analytics platform that enables investment professionals to tap the internet to improve their performance. With offices in Singapore and California, HedgeSPA applies big data techniques to asset selection. It combines forward-looking market scenarios to reduce portfolio drawdown by as much as 75% and automates day-to-day portfolio management tasks. Users can gain competitive access to cloud-based investment analytics that were previously exclusive and cost prohibitive.

- KYC-Chain – uses biometrics, emerging technologies and distributed ledger (blockchain) tech to streamline onboarding processes and provide consensus on identity. This enables front line sales and compliance officers to cost-effectively onboard and continuously interact with retail clients and other financial institutions in a secure, consumer-centric encrypted environment. The Singapore-based company’s platform is live and in production at several banks.

- Lattice – has developed portfolio support software for investors, portfolio managers, risk managers and traders. This Hong Kong-based startup’s platform contains a view-driven portfolio optimizer and flexible portfolio analytics to help clarify investors’ rationale for precise and quick decisions and implementation. It helps to discover and precisely manipulate intentional or unintentional exposures, to commodities, currencies, sectors or even countries. Once a genuine investment objective is established, Lattice EPD delivers “one-click” balanced portfolio.

- Privé Managers – is a completely integrated and comprehensive wealth and asset management platform powered by a proprietary bionic advisory engine. The Hong Kong-based startup’s platform is already being used by several global financial institutions in Asia and Europe. Its modular-based approach meets the diverse needs of financial intermediaries and advisors to more efficiently grow their assets, while reducing costs through technology solutions.

- Seerene – provides insights, actionable analytics and transparency to improve efficiency and streamline costs. Berlin-based, with offices in Hong Kong and New York, Seerene connects to existing data sources within an enterprise, aggregates the information and offers what it calls “an x-ray vision,” viewable on a dashboard. Seerene monitors various dollar-effects of technical debt, digital transformation as well as change across all software stacks, teams and technologies. The aim is to help chief information officers and IT executives improve efficiency and streamline costs.

- SIORK – helps financial institutions evaluate customer data and detect criminal activities such as fraud and money laundering in both developed and emerging markets. This Tokyo-based startup, with offices in Taiwan and the U.S. has a product that automatically learns customer behaviors, identifies suspicious events and provides a real-time transaction blocking mechanism to the customer for crime prevention. What makes the product unique is its comprehensive Chinese-character fuzzy matching algorithm with artificial intelligence learning ability that enables global financial institutions to analyze Chinese-character based raw data, such as customer names, and unstructured message information.

- TNG Wallet – offers an e-wallet for payment to merchants, person-to-person fund transfer, global bill payments, SIM card top-ups, foreign exchange transactions, and year-round cash withdrawal. It has 370,000 downloads with top-up points via convenience stores, ATM terminals, credit card and a variety of online banking platforms. It gives merchants access to an affordable non-cash payment option with low handling fees, improvement in their cash flow through TNG’s fast settlement of transactions with merchants, and a customer relationship management tool that allows merchants to further engage with customers. TNG has extended its eWallet across 12 countries in Asia.

Chief executive officer of Cyberport, Herman Lam, announced during the event that it would extend its agreement with Accenture to host the program on site for another three years.

“Cyberport has collaborated with Accenture since 2014 to foster a mentorship program for fintech startups,” said Lam. “This year we unveiled an entire new section, solely dedicated to fintech, in our Cyberport facilities, underscoring our ongoing and growing commitment to fintech in the Greater China region. We are committed to taking a leadership position in facilitating new business development in Hong Kong.”

The FinTech Innovation Lab Asia-Pacific is modelled on a similar program that Accenture co-founded in 2010 with the Partnership Fund for New York City, the US$150 million investment arm of the Partnership for New York City (www.pfnyc.org). In 2012, Accenture and a dozen major banks in London launched the FinTech Innovation Lab London, with support from the city’s mayor and other government bodies. In 2014, Accenture launched FinTech Innovation Labs in Asia-Pacific and Dublin, Ireland.

Globally, the Labs’ alumni companies have raised more than US$386 million in financing after participating in the program. Four companies from the New York FinTech Innovation Lab have been acquired, two in 2015 alone, including Standard Treasury and BillGuard.

About Accenture

Accenture is a leading global professional services company, providing a broad range of services and solutions in strategy, consulting, digital, technology and operations. Combining unmatched experience and specialized skills across more than 40 industries and all business functions – underpinned by the world’s largest delivery network – Accenture works at the intersection of business and technology to help clients improve their performance and create sustainable value for their stakeholders. With approximately 384,000 people serving clients in more than 120 countries, Accenture drives innovation to improve the way the world works and lives. Visit us at www.accenture.com.

View source version on businesswire.com: http://www.businesswire.com/news/home/20161108005009/en/