PARIS--(BUSINESS WIRE)--

Regulatory News:

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20180703005395/en/

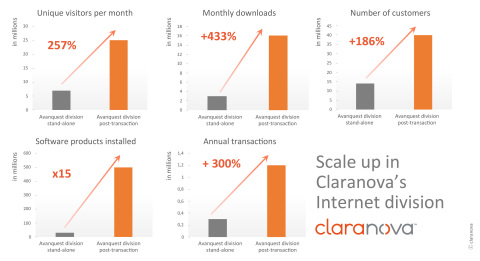

(Graphic: Claranova)

Claranova (Paris:CLA) is pleased to announce the completion of all conditions precedent and the signature on July 1, 2018 of the final agreement for the takeover by Avanquest of the Canadian group holding the Upclick, Lulu Software and Adaware businesses.

This international Internet group has three areas of expertise:

- E-commerce processing through Upclick, one of the most modern platforms in the world;

- Document management and PDF applications with Lulu Software, one of the world’s leading players for PDF solutions with its SodaPDF products;

- Internet security with the Adaware anti-virus and security solutions, known worldwide.

This transaction fits perfectly with Claranova’s strategy and embodies the transformation of its Avanquest division, now firmly focused on monetizing internet traffic. With the integration of these profitable and high-growth businesses, Avanquest will launch a virtuous cycle generating increased revenue and profit.

For example, in the first-half of 2017-2018 (July to December 2017), the Avanquest division would have reported pro forma revenue of €35.2 million1 (up +78% compared with Avanquest alone) and EBITDA2 of €4.7 million1 (up +295% compared with Avanquest alone), representing an operating margin3 of 13% (compared with 6% currently).

|

July-Dec. 2017 in millions of euros |

Avanquest division stand-alone |

Upclick + SodaPDF |

Avanquest |

Impact of |

||||

| Revenue | 19.7 | 15.5 | 35.2 | +78% | ||||

| EBITDA | 1.2 | 3.5 | 4.7 | +295% | ||||

| EBITDA / Revenue (%) | 6.1% | 22.9% | 13.5% |

At the end of March 2018, pro forma 9-month revenue would have been €53.1 million5, compared with €28.3 million reported by the Avanquest division alone, an increase of 87.7%. If included, the acquired Canadian businesses would have had a positive impact on the Avanquest division’s revenue of 109% for the last quarter.

This is also a major transaction at Group level. Based on consolidated figures for July to December 2017, the impact on revenue and on EBITDA would have been +17% and +125%, respectively, increasing the operating margin from 3.1% to 6.0%.

|

July.-Dec. 2017 in millions of euros |

Claranova group |

Upclick + SodaPDF |

Claranova group |

Impact of |

||||

| Revenue | 89.9 | 15.5 | 105.4 | +17.2% | ||||

| EBITDA | 2.8 | 3.5 | 6.3 | +124.9% | ||||

| EBITDA / Revenue (%) | 3.1% | 22.9% | 6.0% | +91.9% |

Scale up in Internet division

The integration of these new businesses, from July 1st 2018, will enable Avanquest to attain 25 million unique visitors per month (+257%) and close to 40 million customers (+186%), increasing the number of monthly downloads by 433%, multiplying by 15 the number of installed software products to reach 500 million, and increasing the number of annual transactions to 1.2 million (+300%).

Synergies expected to significantly improve the Internet division’s profitability

The highly complementary nature of their activities, the work experience shared by the teams and the synergies to be implemented should generate even more improvements in the Avanquest division’s revenue and operating margin.

As already announced, the acquisition balance of €17 million (USD 20 million) will be financed by a loan, currently under negotiation, and repaid in full from operating profits of the acquired companies.

For Pierre Cesarini, CEO of the Claranova group: “The initial operating results of these acquisitions are already excellent and extremely encouraging going forward. The Claranova group will continue its consolidation strategy to make its Internet subsidiary, Avanquest, a major European player in the monetization of internet traffic and reach the €100 million revenue milestone, with profitability of 15% to 20%, as quickly as possible.”

Next Claranova group event:

2017-2018 annual revenue: August 8, 2018

About Claranova:

A global Internet and mobile player, Claranova is one of the few French companies in this sector to post sales of over EUR 130 million, more than half of which is generated in the United States. Claranova focuses its strategy on three areas of business – digital printing through the Group’s PlanetArt division, management of the Internet of Things (IoT) via the myDevices division and e-commerce through the Avanquest division:

- PlanetArt: A world leader in mobile printing, specifically via the FreePrints offer – the cheapest and simplest way to print photos from a smartphone – FreePrints is already a must-have for several million customers, a figure that has grown every year since its launch;

- myDevices: A global platform for IoT (Internet of Things) management enabling major corporations from different business sectors to quickly develop and roll out IoT solutions for their customers;

- Avanquest: the Group’s legacy activity covering the distribution of third-party software, a business that is shifting towards the monetization of Internet traffic.

For more information on the Claranova group: www.claranova.com or www.twitter.com/claranova_group

1 Pro forma figures, not audited.

2 EBITDA is

used to monitor the operating profitability of the various businesses.

It is equal to recurring operating income before depreciation,

amortization and share-based payments.

3 Defined as the

ratio of EBITDA to revenue.

4 Figures not audited

5

Figures not audited

CODES

Ticker: CLA

ISIN: FR0004026714

View source version on businesswire.com: https://www.businesswire.com/news/home/20180703005395/en/