FORT LAUDERDALE, Fla.--(BUSINESS WIRE)--

National Beverage Corp. (NASDAQ: FIZZ) today announced exemplary final results for its fiscal year ended April 29, 2017:

This Smart News Release features multimedia. View the full release here: http://www.businesswire.com/news/home/20170713005605/en/

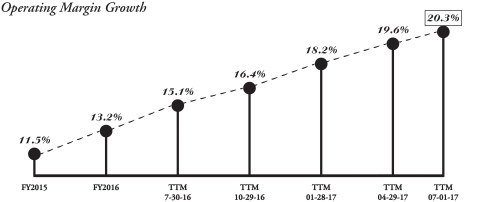

Operating Margin Growth. (Graphic: Business Wire)

FIZZ Facts

- May + June = Two Record Months for FY2018

- Operating Margins climb to 20.3% TTM July 1, 2017

- $11.66 in Dividends declared 2004-2017

- Shasta Sparkling Water SDA (soft drink alternative) - major distribution advances

| Fiscal Years ended April 29, 2017 and April 30, 2016: | |||||||||||||||||||

|

(Dollars in millions except EPS) |

|||||||||||||||||||

| Revenues | Op. Income | Net Income | EPS | EBITDA* | |||||||||||||||

| FY 2017 | $ 827 | $ 162 | $ 107 | $2.30 | $ 175 | ||||||||||||||

| YOY Growth | 17% | 75% | 75% | 75% | 67% | ||||||||||||||

| FY 2016 | $ 705 | $ 93 | $ 61 | $1.31 | $ 105 | ||||||||||||||

|

Press Release dated May 4, 2017 – ‘Look-See’ Estimate: |

|||||||||||||||

|

(Dollars in millions except EPS) |

|||||||||||||||

| Revenues | Net Income | EPS | EBITDA* | ||||||||||||

| FY 2017 | $ 826 | $ 106 | $2.27 | $ 174 | |||||||||||

“The release of our year-end financial statements certified that FY 2017 was the best year in the history of National Beverage – absolutely!” stated Chairman and Chief Executive Officer, Nick A. Caporella. “Beating the estimates of both our fans and cash-poor detractors, and even our own ‘look-see’ estimate, Team National posted industry-leading revenue and earnings growth. Our long-term shareholders also enjoyed another banner year; 90% price appreciation + $1.50 per share dividend paid + another $1.50 per share dividend payment on the way.

There is no doubt our exceptional financial results are the result of Team National’s creativity combined with executing the right strategy. This is evident in the unrivaled success of LaCroix . . . from its award-winning packaging, to its unmatched flavor essences, to its unique digital marketing program. This creativity is now also focused on Shasta Sparkling Water, our SDA (soft drink alternative) which features the industry’s first ‘clean label’. With the taste profile of a traditional soft drink in a ‘100% all-natural’ beverage, the Shasta Sparkling Water line is targeted to those ‘crossover consumers’ within the $81 billion US carbonated soft drink segment seeking guilt-free refreshment containing no calories, sodium or sweeteners.

A break from tradition: Salubrious

When people ask why National Beverage’s stock trades the way it does . . . I remind them that a pharmaceutical company that develops a drug with the potential to help or cure (although that drug may only be sold in a part of the United States) . . . its potential is being traded.

When potential is unable to be quantified, but is undergoing excessive growth performance (with no visible end to these remarkable results), it qualifies for . . . GPE – Gross Price/Earnings Index or Price/Earnings Ratios that reflect this financial phenomenon.

What better feelings can there be than those that make the mind and body feel awesome while simultaneously invigorating your glorious self-esteem? What determines the ultimate potential for this kind of Innovation? A healthy guarantee; the true side effects – super great feelings and a long-lasting hydration afterglow that allures one to want more! How much better does it get? Try it . . . and see!

Why National? Our innovations are so far in advance of anyone and why is this? We are blessed with natural talent . . . such as an inventor, scientist or doctor. BrandED, Shelf Marketing, Shelf Demographics, Cúrate, Pamplemousse, Múre Pepino – our creative genius at work, and let’s not forget – GPE. That’s who we are and that’s why our stock trades the way it does – We are National Beverage Corp.!

Does this answer your question?” a passionate Caporella queried.

National Beverage’s iconic brands are the genuine essence . . . of America

“Patriotism” – If Only We Could Bottle It!

WE SPARKLE . . . AMERICA SMILES!

| National Beverage Corp. | ||||||||||||||||||||||||

| Consolidated Results for the Periods Ended | ||||||||||||||||||||||||

| April 29, 2017 and April 30, 2016 | ||||||||||||||||||||||||

|

(in thousands, except per share amounts) |

||||||||||||||||||||||||

| Three Months Ended | Fiscal Year Ended | |||||||||||||||||||||||

| April 29, 2017 | April 30, 2016 | April 29, 2017 | April 30, 2016 | |||||||||||||||||||||

| Net Sales | $ | 212,066 | $ | 179,034 | $ | 826,918 | $ | 704,785 | ||||||||||||||||

| Net Income | $ | 29,161 | $ | 17,537 | $ | 107,045 | $ | 61,198 | ||||||||||||||||

| Earnings Per Common Share | ||||||||||||||||||||||||

| Basic | $ | .63 | $ | .37 | $ | 2.30 | $ | 1.31 | ||||||||||||||||

| Diluted | $ | .62 | $ | .37 | $ | 2.29 | $ | 1.31 | ||||||||||||||||

| Average Common Shares | ||||||||||||||||||||||||

| Outstanding | ||||||||||||||||||||||||

| Basic | 46,574 | 46,546 | 46,564 | 46,452 | ||||||||||||||||||||

| Diluted | 46,789 | 46,739 | 46,770 | 46,671 | ||||||||||||||||||||

|

Sparkling Performance |

||

| • |

Net income for FY 2017 more than doubled from 2015. |

|

| • | FIZZ Shareholders enjoyed 93% total Return on Investment in FY 2017. | |

| • | LaCroix posted the largest volume and share gain among all top domestic water brands. (1) | |

| • | Natural Sparkling Waters are growing at 4 times the rate of bottled water. (2) | |

| • | Bottled water surpassed carbonated soft drinks to become the largest beverage category by | |

| volume in the U.S. (3) | ||

This press release includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements involve risks, uncertainties and other factors described in the Company's Securities and Exchange Commission filings which may cause actual results or achievements to differ from the results or achievements expressed or implied by such statements. The Company disclaims an obligation to update or announce revisions to any forward-looking statements.

*Although the Company reports its financial results in accordance with accounting principles generally accepted in the United States ("GAAP"), management believes that the disclosure of EBITDA, a non-GAAP financial measure, may provide users with additional insights into the operating performance of the business. EBITDA (in millions) of $175.2 and $104.9 for the fiscal years ended April 29, 2017 and April 30, 2016, respectively, is calculated by adding the following expenses back to Net Income: Depreciation and Amortization of $12.8 and $12.1; Net Interest (Income) Expense of ($.5) and $.1; and Provision for Income Taxes of $55.8 and $31.5.

(1) Beverage Digest 2017 Fact Book 22nd Edition: Calendar Year 2016. (2) Nielsen Multi-Outlet: Latest 52 weeks ending 5/21/17. (3) Beverage Marketing Corp. 2016.

View source version on businesswire.com: http://www.businesswire.com/news/home/20170713005605/en/