TOKYO--(BUSINESS WIRE)--

Sompo Japan Nipponkoa Insurance, Daiichi Kotsu Sangyo and Accenture (NYSE: ACN) are collaborating to build a deep learning algorithm using the Intel® IoT Platform Reference Architecture to better understand individual driving habits and identify new ways to transform driver safety within Japan’s transportation industry.

This Smart News Release features multimedia. View the full release here: http://www.businesswire.com/news/home/20170824005006/en/

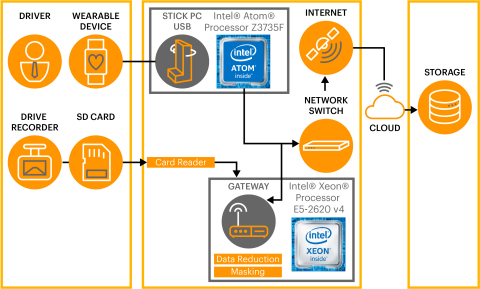

Data Flow Overview (Graphic: Business Wire)

The deep learning algorithm could enable transportation companies to provide personalized safety instructions for drivers, helping reduce the number of accidents, inform the development of optimal driver rosters, and enhance training programs.

Sompo Japan Nipponkoa Insurance will collect data from connected devices installed in Daiichi Kotsu Sangyo’s taxis. In addition to cameras capturing images and telemetry tools recording journey data, biometric information such as heart rates will be collected from consenting taxi drivers through wearable devices.

As part of an ongoing strategic relationship between Accenture and Intel, the data will be processed securely and anonymously using the Intel® IoT Platform Reference Architecture that includes Intel® processor-based servers equipped with Intel®’s high-performance Xeon processors, Intel® Gateway for data collection, and edge computing image processing technology. The data will then be uploaded to the cloud for secure storage and analytics processing.

Accenture will use the input to develop an algorithm that will automatically assess the accident risk for each driver by collating and analyzing images, biometrics, and vehicle data indicating speed and driving behavior. Deep learning, which is one of the emerging advanced analytics techniques available today, will be integral to the data platform.

In an initial Proof of Concept experiment conducted in March 2017 that used data collected from 100 taxis and 100 drivers, the deep-learning algorithm created intelligence that identified signs of drivers’ drowsiness and near-miss accidents from their heart-rate changes and driving behavior.

“Rapid advances in IoT and autonomous driving technologies are bringing new challenges that can only be addressed by using new technologies such as this deep learning algorithm,” said Takuya Kudo, Data Science Center of Excellence global lead and Japan lead for Accenture Analytics, part of Accenture Digital.

As part of this innovative collaboration, Accenture will continue to create new intelligence by applying the latest analytics technologies to address industry challenges. For example, the ability to analyze images on a large, commercial scale is still being developed, and as part of this project Accenture is applying the latest innovations in advanced analytics and data science tools to enable this.

About Accenture

Accenture is a leading global professional

services company, providing a broad range of services and solutions in

strategy, consulting, digital, technology and operations. Combining

unmatched experience and specialized skills across more than 40

industries and all business functions – underpinned by the world’s

largest delivery network – Accenture works at the intersection of

business and technology to help clients improve their performance and

create sustainable value for their stakeholders. With more than 411,000

people serving clients in more than 120 countries, Accenture drives

innovation to improve the way the world works and lives. Visit us at www.accenture.com.

Accenture Analytics, part of Accenture Digital, helps clients to use analytics and artificial intelligence to drive actionable insights, at scale. Accenture Analytics applies sophisticated algorithms, data engineering and visualization to extract business insights and help clients turn those insights into actions that drive tangible outcomes – to improve their performance and disrupt their markets. With deep industry and technical experience, Accenture Analytics provides services and solutions that include, but are not limited to: analytics-as-a-service through the Accenture Insights Platform, continuous intelligent security, machine learning, and IoT Analytics. For more information, follow us @ISpeakAnalytics and visit www.accenture.com/analytics.

About Sompo Japan Nipponkoa Insurance

Sompo Japan Nipponkoa

Insurance Inc. is a member of the SOMPO Holdings Group managed by the

parent company SOMPO Holdings. Based on the group management philosophy

of “We will at all times carefully consider the interests of our

customers when making decisions that shape our business. We strive to

contribute to the security, health, and wellbeing of our customers and

society as a whole by providing insurance and related services of the

highest quality possible” SOMPO Holdings aims to be the best customer

service provider both at home and abroad. As the core company of the

SOMPO Holdings Group, Sompo Japan Nipponkoa has established a network

spanning 211 cities in 32 countries including Japan, and in addition to

insurance underwriting, the company also provides services such as

accident response and risk engineering. In addition to aiming to be a

property and casualty insurance company that is most appreciated by the

customers and leads the industry not only in scale but also service

quality, Sompo Japan Nipponkoa is also driving the creation of a “theme

park for the security, health, and wellbeing of customers” aimed by the

group.

View source version on businesswire.com: http://www.businesswire.com/news/home/20170824005006/en/