BIRMINGHAM, Ala.--(BUSINESS WIRE)--

In recognition of April as National Financial Literacy Month, Regions Bank on Friday announced new initiatives to help more people take charge of their finances.

This Smart News Release features multimedia. View the full release here: http://www.businesswire.com/news/home/20170407005117/en/

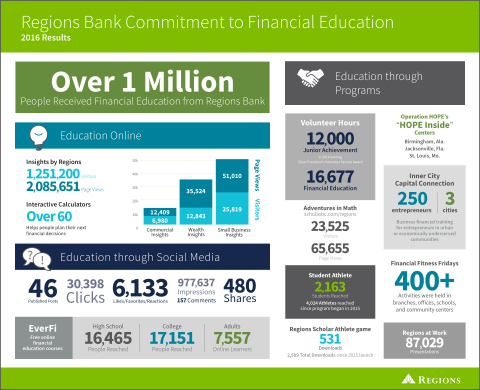

Regions Bank reached more than 1 million people in 2016 with financial advice, guidance and education. (Photo: Business Wire)

“What we find is many people think they’ll have plenty of time later in life to save for the future, or they feel like they have too much debt or too little income to save very much,” said Joye Hehn, Financial Education Content Manager for Regions Bank. “But the truth is, no matter where you are in life, the time to prepare for your financial future is now. And no matter how much, or how little, you have to begin, we have insights, tools and resources to help you develop a strategy to reach your financial goals.”

Initiatives underway at Regions this month include public events where anyone interested in learning how to take charge of their finances can attend and gain valuable insights. The high-energy, high-impact events will take place in:

- Nashville, Tenn. – Saturday, April 22, 2017, at 8:00 a.m. at Beech Creek Missionary Baptist Church, 3101 Curtis St., Nashville, Tenn., 37218

- Memphis, Tenn. – Saturday, April 22, 2017, at 10:30 a.m. at the offices of Binghampton Development Corp., 280 Tillman St, Memphis, Tenn., 38112

- Atlanta, Ga. – Monday, April 24, 2017, at 5:30 p.m. at the Transamerica Building, 6475 E. Johns Crossing, Johns Creek, Ga., 30097

- Tampa, Fla. – Wednesday, April 26, 2017, at 5:30 p.m. at the United Way Suncoast, 5201 W. Kennedy Blvd., Ste. 600-Jacaranda Room, Tampa, Fla., 33609

Further, Regions is adding more to its extensive library of free financial education online. Insights by Regions on Regions.com provides a constant stream of articles, videos, infographics, checklists and tips. Over 300 pieces of content are available, organized by life stages and topics, with more added every week. Among the content offered:

- Nearly 60 calculators help people, as well as businesses, set up budgets and manage their finances. These include savings-specific calculators that help people plan for college, build personal wealth and more.

- Articles such as How to Pay off Debt: 6 Steps to Success as well as The Rules of Thumb for Saving offer ideas on how people can reduce their debt burdens and prioritize their spending.

- How to Increase Your Savings Account Balance helps people take the next step toward creating a financial safety net.

- Young professionals are guided on how to budget after landing a first job.

- Steps for combining finances after marriage give couples helpful advice on paying for shared responsibilities.

- When it comes to major purchases, insights are offered on financing a home and determining how much a homebuyer can afford. Likewise, additional content helps people determine whether renting may be better than buying.

- Information is available to help people buying a car.

- Articles also focus on helping children learn about money management.

- Ways to slash grocery bills, along with infographics on making smarter decisions at the supermarket help families make smart choices on meal expenses.

- Additional content takes readers through all stages of life, including retirement planning, financial hardships and more.

“We’re making financial education easily accessible to anyone who wants it,” Hehn said. “You don’t have to be a Regions customer. All you need is a desire to learn more about managing money wisely.”

While National Financial Literacy Month lasts throughout April, Regions’ commitment to financial education is year-round. Among examples:

- Regions associates visit schools and conduct financial education classes for students at all levels.

- Regions works with education provider Scholastic to offer cost-free financial curriculum to teachers and families.

- Regions works with education technology company EverFi to provide the Regions Bank Financial Scholars Program to high schools in nine states at no cost to the schools. Regions also partners with EverFi to offer financial education to various colleges and universities.

- Regions brings real-world financial scenarios to college campuses to help student-athletes learn about managing money.

- Regions offers financial wellness information through its Financial Learning Center, which is a free online resource that can be used to increase financial knowledge whenever it’s most convenient. It includes a variety of topics, and each one takes less than 10 minutes to complete.

- Regions associates visit workplaces and offer employees financial education and one-on-one guidance. During 2016, Regions offered over 80,000 of these “Regions at Work” financial education presentations.

- Regions works with nonprofits to share cost-free financial education on several levels. Examples include Operation HOPE’s “HOPE Inside” centers in Birmingham, Ala.; Jacksonville, Fla.; and St. Louis, Mo.

- Each year, Regions works with the nonprofit Inner City Capital Connections to offer no-cost business financial training for entrepreneurs in urban or economically underserved communities.

In 2016, Regions’ financial education initiatives have reached more than 1 million people. Organizations interested in complimentary financial education programs are encouraged to visit any Regions Bank branch or make an appointment through Regions.com to discuss further.

About Regions Financial Corporation

Regions Financial Corporation (NYSE:RF), with $126 billion in assets, is a member of the S&P 500 Index and is one of the nation’s largest full-service providers of consumer and commercial banking, wealth management, mortgage, and insurance products and services. Regions serves customers across the South, Midwest and Texas, and through its subsidiary, Regions Bank, operates approximately 1,500 banking offices and 1,900 ATMs. Additional information about Regions and its full line of products and services can be found at www.regions.com.

View source version on businesswire.com: http://www.businesswire.com/news/home/20170407005117/en/