DES MOINES, Iowa--(BUSINESS WIRE)--

Forget the gloom and doom—small business owners are feeling good. According to the Principal Financial Well-Being IndexSM: Business Owners, 94 percent say their business is either growing or stable. Fifty percent of businesses fell into the “growing” category, up 25 percent from 2015.

This Smart News Release features multimedia. View the full release here: http://www.businesswire.com/news/home/20160915005865/en/

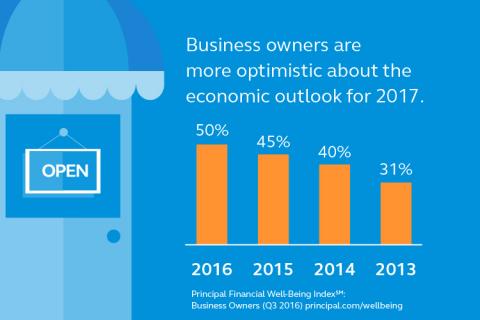

Principal Financial Well-Being Index: Business Owners (Graphic: Principal)

Business owners are not only confident in their success today, but looking forward to the prospects of tomorrow. Fifty percent are optimistic about the economic outlook for 2017, an increase from 45 percent last year. Over one-third (36 percent) plan to increase wages, and the same amount plan to add to staff.

“Small businesses employ nearly half1 of American workers, so they’re hugely important,” said Amy Friedrich, senior vice president at Principal Financial Group®. “When they’re feeling confident, the economy does better. And when we see that 92 percent maintained or increased staff in the last year, we know they’re not just feeling good – they’re taking action that has real economic impact.”

This year, 87 percent of business owners said they’re financially healthy, up from 82 percent last year. Sixty-nine percent have surplus capital on hand, and only seven percent are holding on to their capital due to political uncertainty.

“This data fits nicely with our view that the U.S. economy is gradually improving, that wage growth is accelerating and that the angst and caution so thoroughly instilled in households and businesses by the severity of the 2008 financial crisis and ensuing economic fallout is steadily diminishing,” said Bob Baur, chief economist at Principal®.

Business and politics

In a hot election year, small business owners are split on the best path forward. Half said the government should be doing more to create an environment to drive business growth. About one quarter (27 percent) feel the government is doing it right.

The most notable political shift in 2016 was in party affiliation. Thirty-eight percent consider themselves to be a Democrat, a significant increase from 26 percent in 2015. Republicans held steady at roughly one-third of small business owners, and those identifying as Independents dipped to 27 percent from 36 percent last year.

About the Principal Financial Well-Being Index

The Principal

Financial Well-Being Index: Business Owners surveyed 604 business owners

nationwide that employ 10 to 500 American workers. This group owns at

least 5 percent of a company that they’re actively involved in managing.

The Index is part of a series of quarterly studies commissioned by The

Principal Knowledge Center examining the financial well-being of

American workers and business owners. The survey was conducted online by

Harris Poll® from June 29 – July 29, 2016.

About Principal®

Principal

helps people and companies around the world build, protect and advance

their financial well-being through retirement, insurance and asset

management solutions that fit their lives. Our employees are passionate

about helping clients of all income and portfolio sizes achieve their

goals – offering innovative ideas, investment expertise and real-life

solutions to make financial progress possible. To find out more, visit

us at principal.com.

Principal, Principal and symbol design and Principal Financial Group are trademarks and service marks of Principal Financial Services, Inc., a member of the Principal Financial Group.

1 Source: “Number of firms, establishments, employment, and payroll by firm size, state, and industry, 2012,” Statistics of U.S. Businesses, SBA Office of Advocacy

View source version on businesswire.com: http://www.businesswire.com/news/home/20160915005865/en/